Welcome to our weekly newsletter on the S&P 500.

This week, the S&P 500 gained 1.1%. On the 4-hour chart, the market experienced ups and downs: volatility on Monday, gains on Tuesday, losses on Wednesday, and additional gains on Thursday and Friday.

However, trading was light due to Thanksgiving week in the US. The 4-hour chart also reveals green trendlines that had provided support since the low two weeks ago. This week, prices crossed these trendlines, breaking them, leading to sideways movement. The index now faces challenges near its previous all-time high, struggling to make significant progress above it.

Our last position, placed on November 20, is currently up by 5.9%.

Are you wondering when to buy the S&P 500 as an investor? Explore our tailored services and join our growing community of do-it-yourself investors who have successfully navigated the market with our guidance.

Premium Guide

Advanced Investing Signals

$139 / Month

Basic Guide

Basic Investing

Signals

$49 / Month

Simple Guide

Selected

Signals

Free

Congratulations! You’ve discovered your new free financial guide. Simply sign up for our most popular service, our Simple Guide.

S&P 500 Daily Chart Update

The daily chart offers a clearer view of the S&P 500’s movements. All key trendlines remain intact, with the green support zone still visible where prices bounced two weeks ago. While the upward move hasn’t been as strong as past rebounds, it continues steadily for now.

The index is still within a wedge pattern, defined by the lower orange trendline (support) and the upper red trendline (resistance). If the S&P 500 tests the orange trendline before reaching the red trendline, this could signal weakness. A move like this may suggest that buyers are losing momentum, potentially leading to a deeper pullback. However, if the index approaches the red trendline first, it would indicate ongoing strength within the wedge.

The gray area on the chart represents a possible short-term cycle bottom. Short-term market cycles, typically 20 to 40 days, suggest this region could mark a temporary low. While this is not a firm prediction, it provides context for the current market environment.

Finally, the 6,000-point psychological level remains a key focus. After testing and pulling back from this level in mid-November, the S&P 500 is making a second attempt to push above it. The next critical observation will be whether prices can hold above this level if they break through.

For subscribers, it is very important to follow our risk management measures that we provide with all our services to protect against losses in case support zones break.

S&P 500: An Unusual Year for Seasonality

Historically, the S&P 500 tends to follow seasonal patterns. Typically, markets weaken leading up to the November election, followed by a rally into the end of the year. This year, however, deviated from the norm. There was no significant correction before the election.

Instead, the S&P 500 has shown exceptional strength throughout the year, with gains far outpacing those of previous years. While the seasonal pattern chart suggests a strong rally to close the year, the deviation earlier in the year indicates that the market may not follow this trajectory. This unpredictability highlights the need for caution when looking at historical trends.

However, it’s important to interpret this seasonality with caution, especially this year, as we have already experienced a significant rise in prices. Investors should consider both seasonality trends and our analysis for a balanced view. Proper risk management is essential in navigating these market conditions.

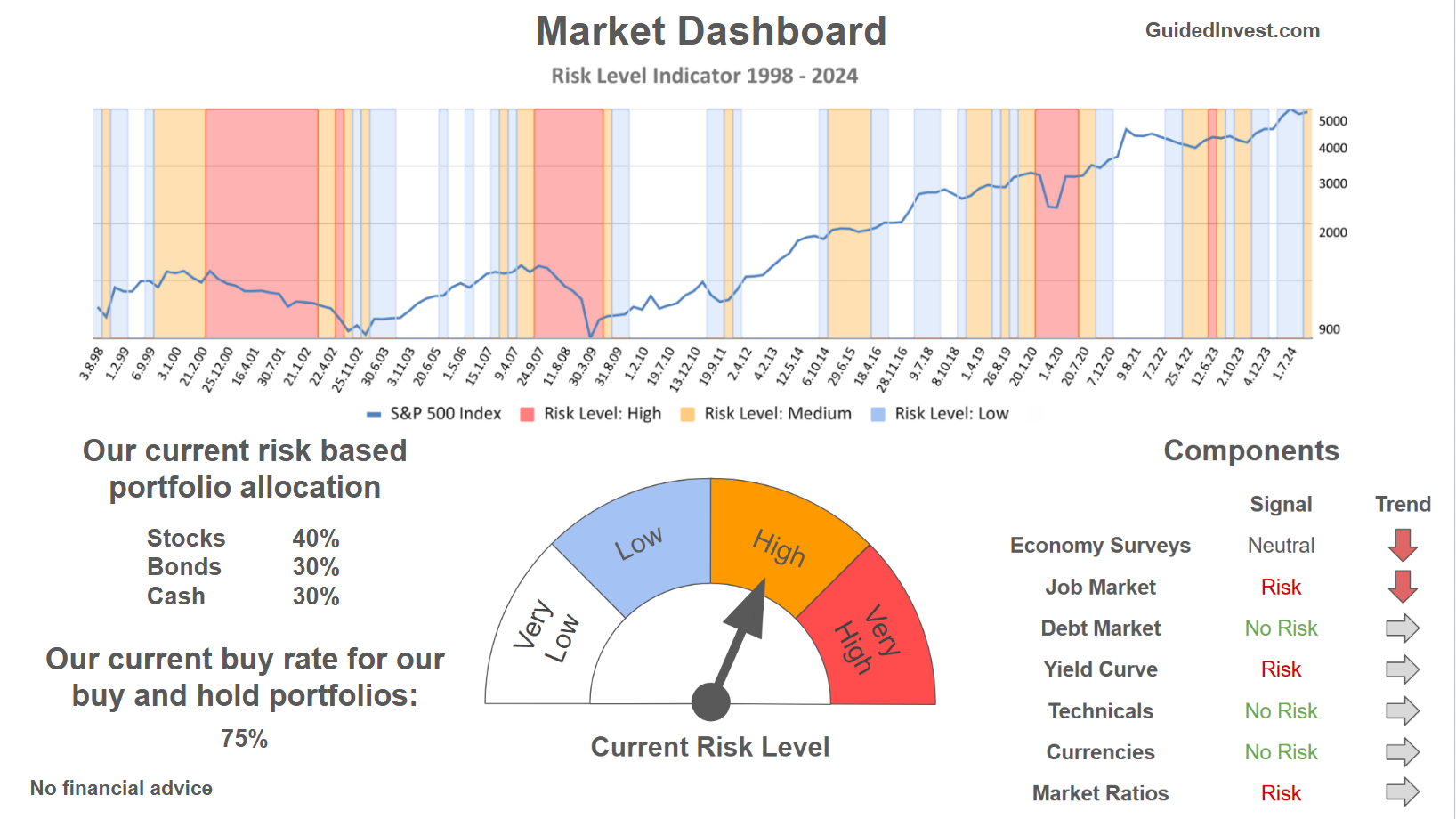

Our Market Dashboard provides a quick overview of the current market conditions and, more importantly, the associated risk. You can view a chart of one of our tools, the Risk Level Indicator, showing predicted risk from 1998 to 2024. If you are interested, you can visit our Dashboard site here.

The world of finance is complex and includes many technical terms. For explanations of these terms, I recommend using the Investopedia dictionary.

Leave a Reply