Welcome to our weekly S&P 500 newsletter. This week, the S&P 500 saw a modest gain of 1.3%. The market started off strong with gains on Monday, followed by a sideways movement on Tuesday and Wednesday. Thursday brought a brief sell-off, but Friday saw the index recover, ultimately closing the week in positive territory. The week’s performance was influenced by Jerome Powell’s speech at the Jackson Hole meeting on Friday, which appeared to bolster investor confidence for future rate cuts. Despite some mid-week volatility, the market’s resilience led to a favorable outcome for the week.

Our last position, placed on August 8th, is currently up by 12.7%.

Are you wondering when to buy the S&P 500 as an investor? Explore our tailored services and join our growing community of do-it-yourself investors who have successfully navigated the market with our guidance.

Premium Guide

Advanced Investing Signals

$139 / Month

Basic Guide

Basic Investing

Signals

$49 / Month

Simple Guide

Selected

Signals

Free

Congratulations! You’ve discovered your new free financial guide. Simply sign up for our most popular service, our Simple Guide.

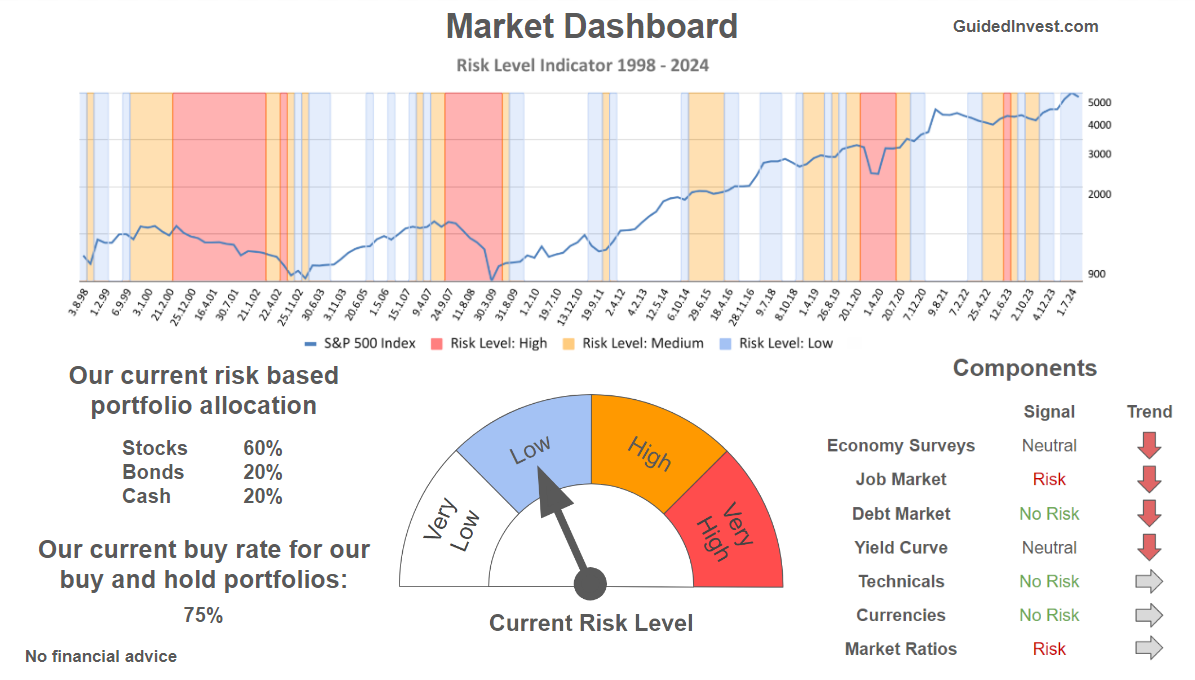

Since the August low, the S&P 500 has risen by 10.6%. While last week saw strong gains, this week’s progress was more modest. Previously, we discussed a key resistance area, and this week, the S&P 500 managed to close above it. However, the index now finds itself in a very narrow range, with a resistance zone just above and a support zone slightly below. Given that the index is currently overbought, the potential for further upside is likely limited. Investors should exercise caution and avoid chasing stocks at this level. Our indicators are signaling increasing risk, as highlighted in our market dashboard. Although we’re not yet in full crisis mode, the trend of these indicators suggests that we are heading in that direction over the next few weeks or months. Therefore, this might be a good time to consider taking some profits or, at the very least, avoid entering aggressive long positions. For subscribers, it’s crucial to follow the risk management measures we provide through our services to protect against potential losses if support zones break.

The next few months

The chart shows the seasonality for the S&P 500 in an election year, indicating anticipated weakness in May, June, and July, followed by strong price increases until early September. This is then followed by a larger correction until the election in early November. From mid-June to the end of July, seasonality suggests some weakness and only moderate price rises, which we have certainly experienced with the recent decline. Now we are in August, which seasonality suggests is the strongest month of the year with an average gain of 3%. Of course, seasonality data should be taken cautiously, especially this year, as we have already seen a significant rise in prices. Investors should consider both seasonality trends and our analysis for a balanced view. Proper risk management is essential in navigating these market conditions.

Our Market Dashboard provides a quick overview of the current market conditions and, more importantly, the associated risk. You can view a chart of one of our tools, the Risk Level Indicator, showing predicted risk from 1998 to 2024. If you are interested, you can visit our Dashboard site here.

The world of finance is complex and includes many technical terms. For explanations of these terms, I recommend using the Investopedia dictionary.

Leave a Reply