Hello everybody, welcome to this week’s analysis of the S&P 500. The index closed the week with a slight loss of about 0.25%. Volatility picked up: the S&P 500 saw some gains on Monday, but hit resistance and then dropped through Tuesday, Wednesday, and Thursday. From peak to trough, the index lost almost 2%, but it managed to recover part of that decline on Friday, ending the week with only a small loss.

Some of the weakness was attributed to renewed concerns about tariffs, which could impact corporate profitability. That may explain the decline we experienced this week.

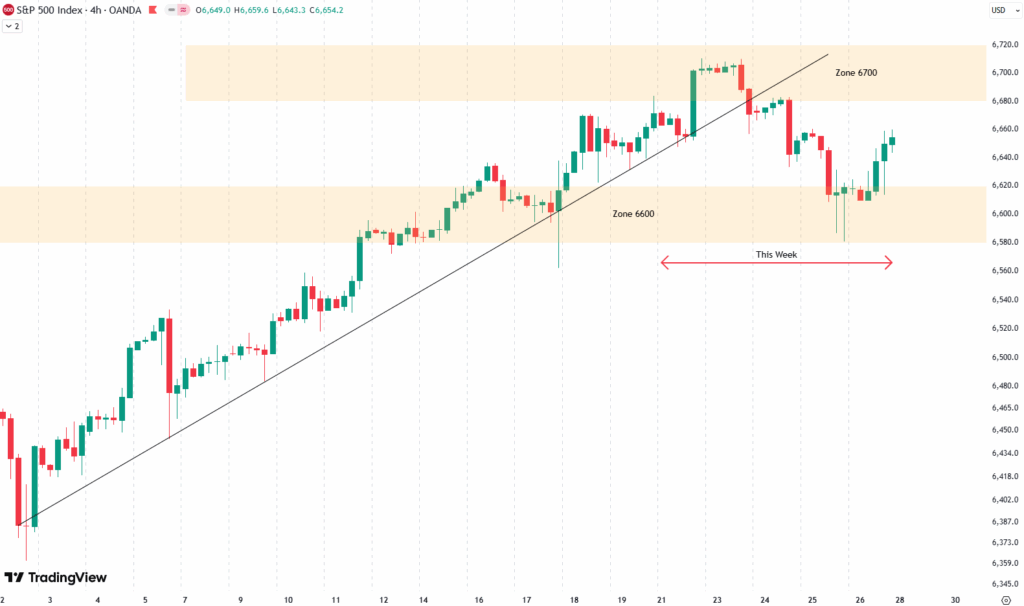

On the 4-hour chart, you can see the black trend line we discussed last week. It was technically respected but was broken on Tuesday. Around the same time, the index tested the orange resistance zone at 6,700 and was rejected from there. This break of the trend line initiated the midweek decline. Support was eventually found around the 6,600 zone, as shown on the chart, and from there the S&P 500 was able to bounce.

Are you wondering when to buy the S&P 500 as an investor? Join our community of smart do-it-yourself investors who are making informed decisions with our expert insights, just by signing up with your email!

Premium Guide

Advanced Investing Signals

Basic Guide

Basic Investing

Signals

Simple Guide

Selected

Signals

Get started today with our free financial guide! Just enter your email, and you’ll start receiving our most popular Simple Guide with exclusive market signals right in your inbox.

Potential Break of Support Could Shift the Trend

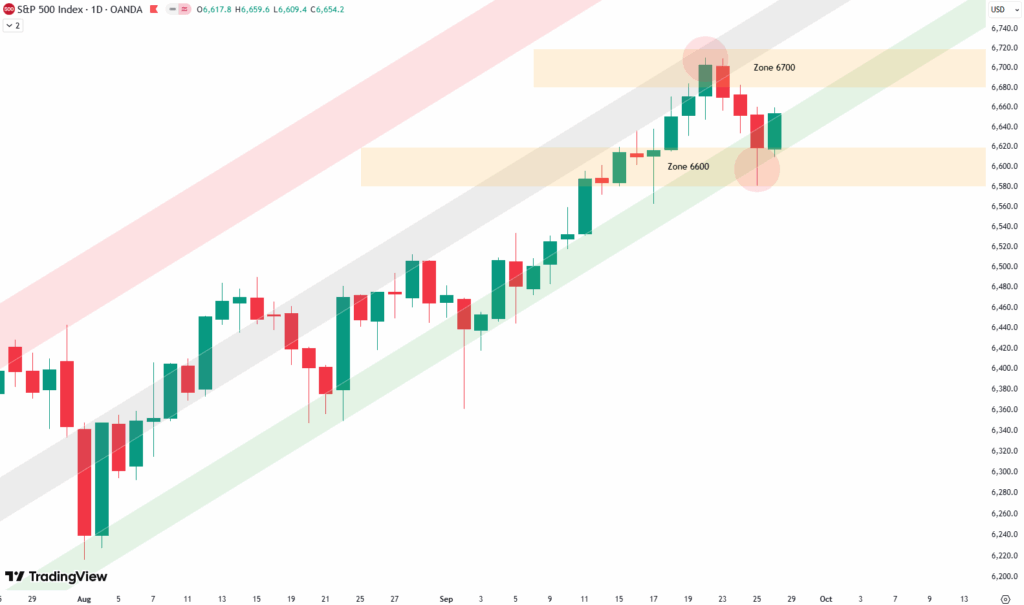

Looking at the daily chart, things get more interesting. The green, gray, and red shaded areas mark the trend lines of the rising channel that has defined the uptrend over the past several months. Last week, we noted that the S&P 500 was overbought and pressing into resistance at 6,700. This level also aligned with the gray shaded middle trend line of the rising channel. The red circle on the chart highlights this rejection, which we anticipated, and indeed it played out this week.

From there, the S&P 500 dropped for three days until it reached the green shaded support area and the 6,600 zone. This was tested very precisely, as shown by the long wick on the daily candle (the second red circle). On Friday, the market bounced off this support.

The key question now is what happens next. A 2% pullback is relatively small compared to the 5–10% decline we have been expecting in the coming weeks. If the S&P 500 can push back up and break through 6,700, the uptrend may continue. But a more likely scenario is another test of 6,700, followed by rejection and a break below the green shaded support area — which would also mean a break of the trend channel. That will be the focus for next week.

Our short-term risk outlook confirms this caution. The indicator remains in the red shaded zone, which signals elevated short-term risk. This week, two additional sell signals were triggered — including one on Friday. Together with last week’s signal, we now have three sell signals lining up closely, pointing toward the possibility of a more significant decline ahead.

Given the overbought situation we saw last week, and the very weak seasonal period at the end of September (historically the weakest part of the year), the probability of a 5–10% correction remains high. It is a time to be cautious, take profits, and perhaps hedge or reduce exposure. This is not a good spot to initiate new buys right now. Next week will be critical.

We also have an article (Update: September 4, 2025) on the broader S&P 500 outlook. From a big-picture perspective, the technicals on the weekly chart are less positive and suggest that another correction could be developing in the coming weeks.

For subscribers it is very important to follow our risk management measures that we provide with all our services to protect against losses in case support zones break

Stay ahead of the market! Sign up for our weekly updates and get additional expert insights on the S&P 500, key support levels, and market trends.

S&P 500: Seasonality Insights for 2025

So far this year, the seasonal pattern for the S&P 500 has played out pretty much as expected. The first few months brought some noticeable volatility, which lines up with what we usually see in the early part of the year. Historically, January and February tend to be choppy, and that turbulence can sometimes stretch into March — and that’s exactly what happened this year.

In April, we had a sharp correction, which doesn’t line up exactly with the seasonality pattern. However, it might have been the May or June weakness playing out early this year in April. Since April, we’ve seen a very strong rise into the summer, all the way to the end of July. That, on the other hand, aligns very well with the seasonality.

Now, of course, we are looking into August and September, which are typically weak months of the year. The setup of starting a downturn in August seems to be right on time when we look at seasonality — you can see how prices in August and September tend to have big swings up and down, with a lot of volatility. Therefore, August and September should be expected to bring some weakness.

We will keep an eye on this, and then, when we come into October, we reach the strongest phase of the year. October, November, and December typically bring the year to an end with very strong seasonality. We will see if this holds true this year as well.

Of course, this isn’t a guarantee — it’s more of a roadmap based on past patterns. Ultimately, seasonal trends provide valuable context, but they must be considered alongside current market dynamics and technical analysis for a clearer picture.

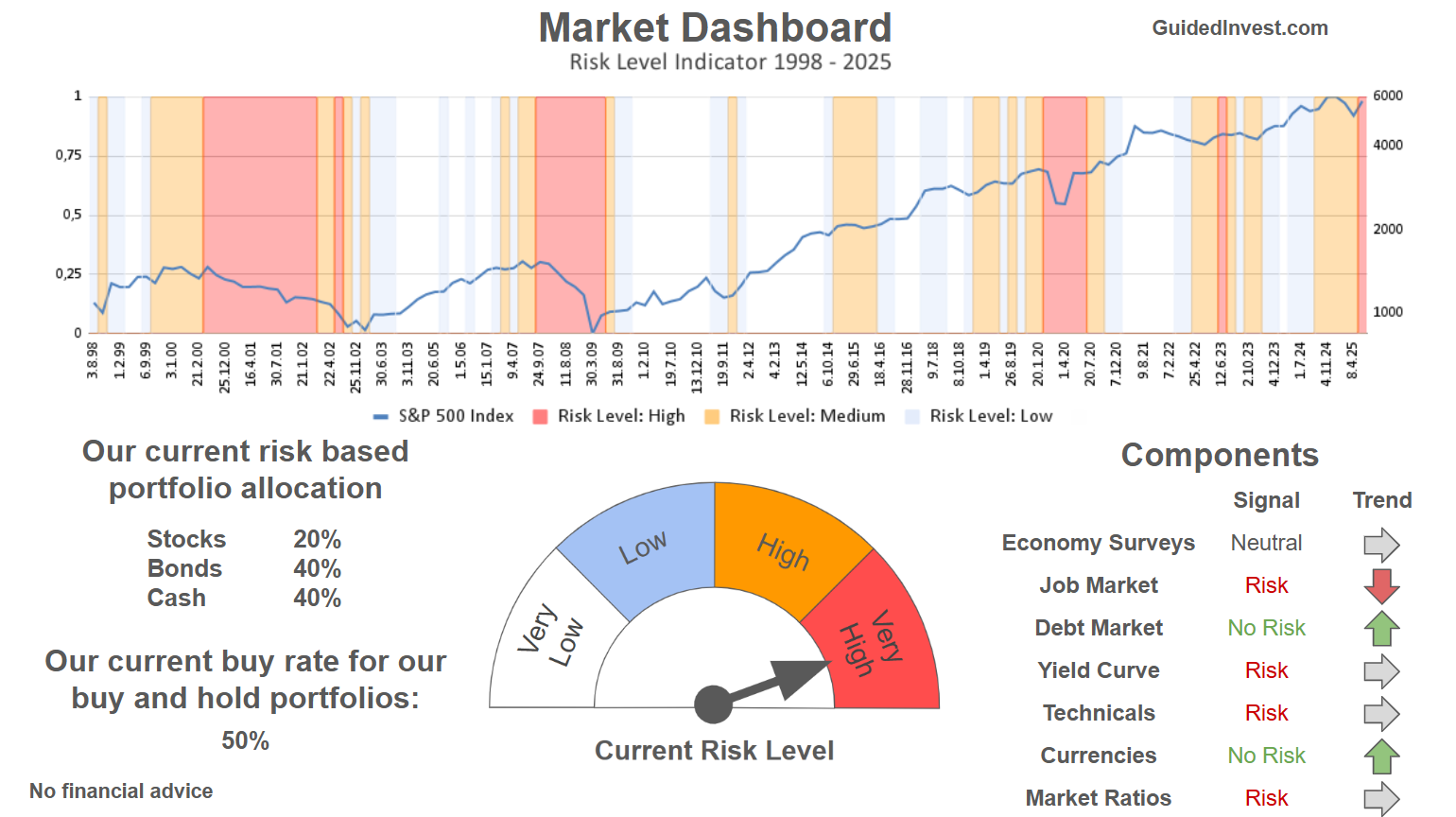

Track Market Risk with Our Dashboard

Our Market Dashboard provides a quick overview of the current market conditions and, more importantly, the associated risk. You can view a chart of one of our tools, the Risk Level Indicator, showing predicted risk from 1998 to 2025. If you are interested, you can visit our Dashboard site here.

The world of finance is complex and includes many technical terms. For explanations of these terms, I recommend using the Investopedia dictionary.

Leave a Reply