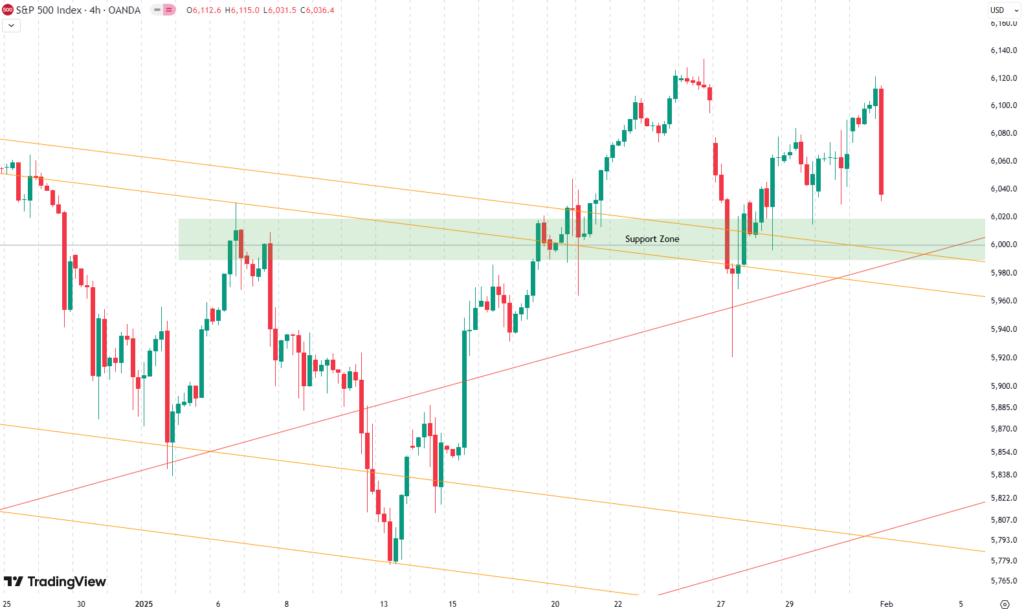

Welcome to our weekly newsletter on the S&P 500. This week, the S&P 500 posted a loss of 1.1%. As shown in the 4‑hour chart covering the last couple of weeks, we saw a strong upward trend that suddenly met some turbulence. Over the weekend, new information emerged about China’s AI DeepSeek—a model that promises similar results to existing AI at a fraction of the cost. This news shook the market on Monday, triggering a sharp 3% plunge. Although the index recovered during the rest of the week, a further sudden drop occurred in the last three hours on Friday. Meanwhile, the FOMC meeting on Wednesday showed that the Fed held rates steady. Despite the meeting’s low impact on the chart, the volatility from the AI scare and rapid drops has left many investors taking note.

Our last position, which we placed on November 20, has been active until December 10, when we sold it for a gain of 5.7%

Are you wondering when to buy the S&P 500 as an investor? Explore our tailored services and join our growing community of do-it-yourself investors who have successfully navigated the market with our guidance.

Premium Guide

Advanced Investing Signals

Basic Guide

Basic Investing

Signals

Simple Guide

Selected

Signals

Congratulations! You’ve discovered your new free financial guide. Simply sign up for our most popular service, our Simple Guide.

6000 Turns Support

Taking a closer look at the daily chart, there are several key points to consider. We have now clearly broken above the 6,000-point level—a resistance that has long been in place—and transformed it into support.

This turnaround began in November last year when the S&P 500 first touched 6,000. After a brief decline, the index reached a new high above 6,000 in early December. Then, during a correction from mid-December into January, the level was tested repeatedly. Over the past two weeks, a strong rise pushed the index above 6,000 once more. On Monday, amid the AI scare, the index dipped but managed to form a large candle with a prominent wick, signaling that support was still intact at this crucial level.

Not only did the S&P 500 retest the 6,000 mark, but it also tested the downward sloping orange trendlines from the past, along with the red trendlines from the weekly chart. All these factors create a bullish setup with multiple layers of support below us. As long as the 6,000-point level holds, we may see further retests and a continuation upward. For subscribers it is very important to follow our risk management measures that we provide with all our services to protect against losses in case support zones break.

The weekly logarithmic chart, with its clear uptrend channel marked by red, gray, and green shaded areas, reinforces this outlook as the index is expected to return to the red zone for another test.

S&P 500: Seasonality Insights for Early 2025

Seasonality charts often provide helpful context for understanding market tendencies. Historically, the S&P 500 exhibits a choppy start to the year, with January and February experiencing turbulence that can extend into mid-March. This seasonal pattern suggests the potential for weakness in the coming weeks.

However, this type of analysis should always be approached cautiously. While seasonal trends indicate broad expectations, they cannot predict the future. Notably, last year saw significant deviations from typical patterns, with strength in the market that outpaced historical norms.

If seasonality holds true, this early choppiness might be followed by stabilization. Still, after the notable price increases seen in late 2024, investors should prepare for possible volatility and ensure proper risk management strategies are in place.

Ultimately, seasonal trends provide valuable context, but they must be considered alongside current market dynamics and technical analysis for a clearer picture. The S&P 500’s behavior during this critical time will reveal whether the seasonal weakness manifests or if the market defies expectations again.

Track Market Risk with Our Dashboard

Our Market Dashboard provides a quick overview of the current market conditions and, more importantly, the associated risk. You can view a chart of one of our tools, the Risk Level Indicator, showing predicted risk from 1998 to 2024. If you are interested, you can visit our Dashboard site here.

The world of finance is complex and includes many technical terms. For explanations of these terms, I recommend using the Investopedia dictionary.

Leave a Reply