Welcome to our weekly newsletter on the S&P 500. This week, the index posted a 0.8% gain, continuing its upward momentum.

The S&P 500 had a strong start with steadily rising prices through the beginning and middle of the week. Only Thursday and Friday saw minor losses. As shown in the 4-hour chart, the trend remains intact with clear upward momentum. The green trendlines on the chart highlight the rising trend that began last week, reinforcing the bullish sentiment.

This steady climb showcases a healthy uptrend, making it an encouraging week for the market.

Our last position, placed on November 20, is currently up by 8.5%.

Are you wondering when to buy the S&P 500 as an investor? Explore our tailored services and join our growing community of do-it-yourself investors who have successfully navigated the market with our guidance.

Premium Guide

Advanced Investing Signals

Basic Guide

Basic Investing

Signals

Simple Guide

Selected

Signals

Congratulations! You’ve discovered your new free financial guide. Simply sign up for our most popular service, our Simple Guide.

S&P 500: A Short-Term Bottom Ahead

On the daily chart, we see a clear rising wedge pattern that has developed over the past few months. This pattern is defined by the orange trend lines providing support at the bottom and a red trend line that limits price movement at the top.

Notably, the price is now compressing at the upper end of the wedge, leaving little room for further movement. A short-term correction may be near, as indicated by the gray shaded area on the chart—a helpful guide for estimating when the next bottom might form.

The 6,000-point level also stands out as an important retest zone. This level aligns with the orange trend line and the November high, making it a critical area to watch if prices dip.

For subscribers, it’s important to follow our risk management measures to protect against losses in case support zones break. While the trend is strong, prices are high, and caution is warranted when considering new long positions.

S&P 500: An Unusual Year for Seasonality

Historically, the S&P 500 tends to follow seasonal patterns. Typically, markets weaken leading up to the November election, followed by a rally into the end of the year. This year, however, deviated from the norm. There was no significant correction before the election.

Instead, the S&P 500 has shown exceptional strength throughout the year, with gains far outpacing those of previous years. While the seasonal pattern chart suggests a strong rally to close the year, the deviation earlier in the year indicates that the market may not follow this trajectory. This unpredictability highlights the need for caution when looking at historical trends.

However, it’s important to interpret this seasonality with caution, especially this year, as we have already experienced a significant rise in prices. Investors should consider both seasonality trends and our analysis for a balanced view. Proper risk management is essential in navigating these market conditions.

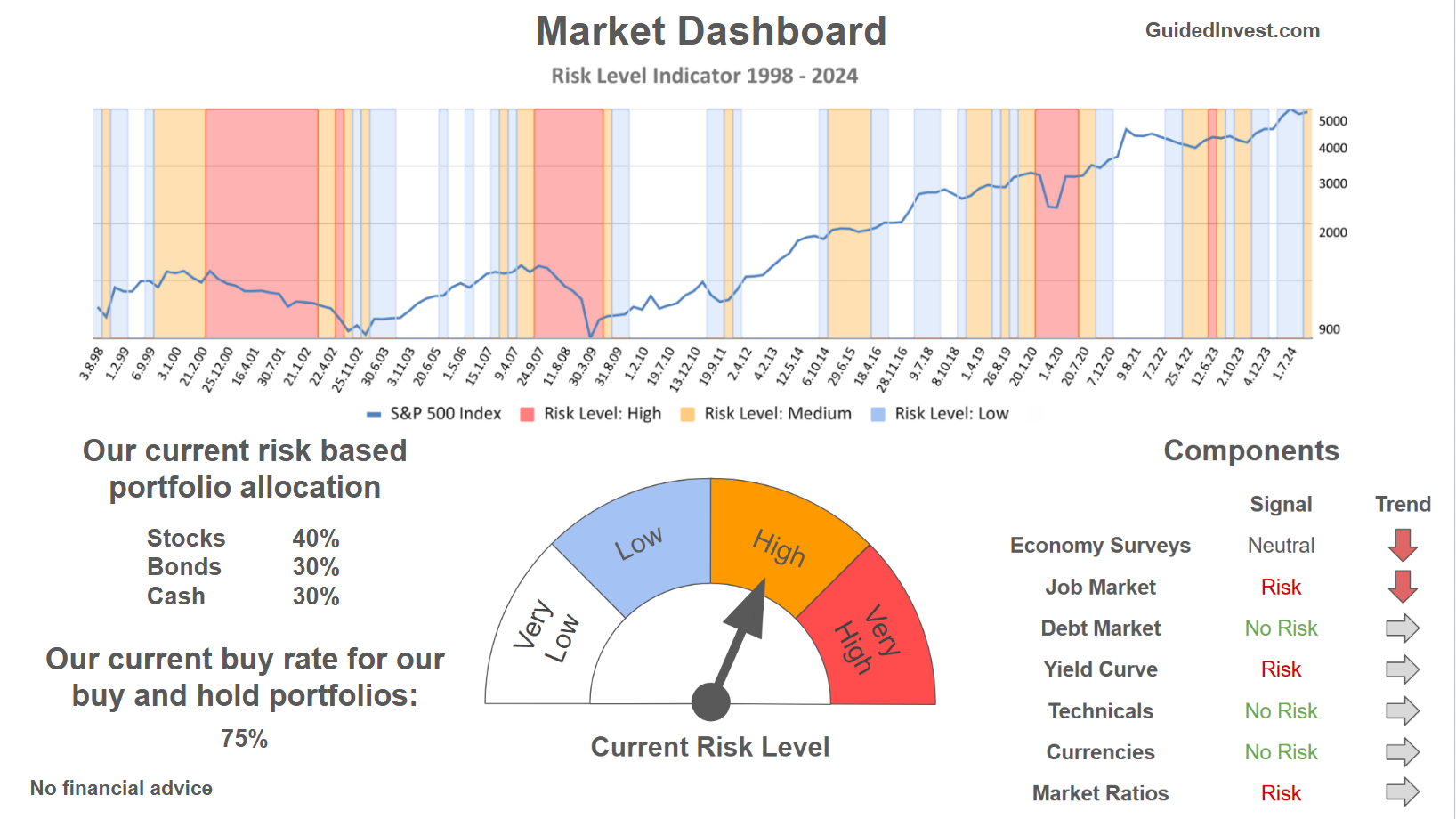

Our Market Dashboard provides a quick overview of the current market conditions and, more importantly, the associated risk. You can view a chart of one of our tools, the Risk Level Indicator, showing predicted risk from 1998 to 2024. If you are interested, you can visit our Dashboard site here.

The world of finance is complex and includes many technical terms. For explanations of these terms, I recommend using the Investopedia dictionary.

Leave a Reply