Weekly Overview: S&P 500 Gains 4.6% on Election Momentum

Welcome to this week’s update on the S&P 500! This past week, the S&P 500 recorded a significant 4.6% gain, driven by strong election-related momentum. Leading up to the election results, we noticed the index hovering near a critical support level, as indicated by the orange trendline on the 4-hour chart. Interestingly, on Tuesday—just before the results started to come in—the S&P 500 began a powerful rally that picked up speed through the week.

The market showed strong support for the election outcome, which added to investor confidence and sustained the rally. By Wednesday, the bullish movement continued, pushing the S&P 500 to close the week up by 4.6%. However, the rally has left the index overbought, as it’s now pressing against the upper Bollinger Bands, while remaining notably above the 50-day moving average, shown as the blue line on the chart. This position suggests that the S&P 500 is experiencing significant bullish momentum, although the overbought status raises caution for potential shifts in market dynamics.

Our last position, which we placed on August 8th, has been active until September 5th, when we sold it for a gain of 7.7%

Are you wondering when to buy the S&P 500 as an investor? Explore our tailored services and join our growing community of do-it-yourself investors who have successfully navigated the market with our guidance.

Premium Guide

Advanced Investing Signals

$139 / Month

Basic Guide

Basic Investing

Signals

$49 / Month

Simple Guide

Selected

Signals

Free

Congratulations! You’ve discovered your new free financial guide. Simply sign up for our most popular service, our Simple Guide.

Key Support Zones in Focus for S&P 500

Since hitting its low in August, the S&P 500 has rallied an impressive 17.8%. Looking at the daily chart, the index tested a bottom trendline—again marked in orange—just before the election, which is also the lower boundary of a rising wedge pattern. This trendline served as solid support, preventing a breakdown and allowing for a strong post-election rally. Alongside the trendline, the S&P 500 also tested the 50-day moving average (the blue line), reinforcing support as the rally continued upward.

Now, the S&P 500 is approaching the red trendlines, which mark the upper resistance of the rising wedge pattern. This pattern has a history of creating slight pullbacks, as seen in previous instances on the chart. With the index currently at its upper Bollinger Band on the daily chart, it signals an overbought condition, a technical factor that could indicate a near-term pullback.

Looking ahead, it will be interesting to see whether the rising wedge pattern holds up over the next few weeks. If the S&P 500 does experience a pullback, the green-highlighted support zone on the chart could serve as a potential level for stabilization. Additionally, the gray-shaded area marks a timeframe for when the next possible bottom may occur, likely in early December. Given the strength of the recent rally, though, any pullback might end up being relatively shallow rather than a sharp decline.

For subscribers it is very important to follow our risk management measures that we provide with all our services to protect against losses in case support zones break

The next few months

Historically, the S&P 500 tends to show seasonal patterns, with certain times of the year seeing more predictable trends. Tracking these patterns can offer investors insights into potential movements in the index. We see a tendency for market weakness in May, June, and July, followed by a period of strong price gains up to early September. However, this is usually succeeded by a larger correction leading up to the election at the beginning of November. The period from mid-June to the end of July is characterized by some market softness, with only modest upward movement, which aligns with the declines we’ve witnessed in August. As we are in November, which is historically a stronger month of the year, we may continue to see this pattern of volatility. Given the historical data, there could be further weakness until the U.S. election on November 5th. However, it’s important to interpret this seasonality with caution, especially this year, as we have already experienced a significant rise in prices. Investors should consider both seasonality trends and our analysis for a balanced view. Proper risk management is essential in navigating these market conditions.

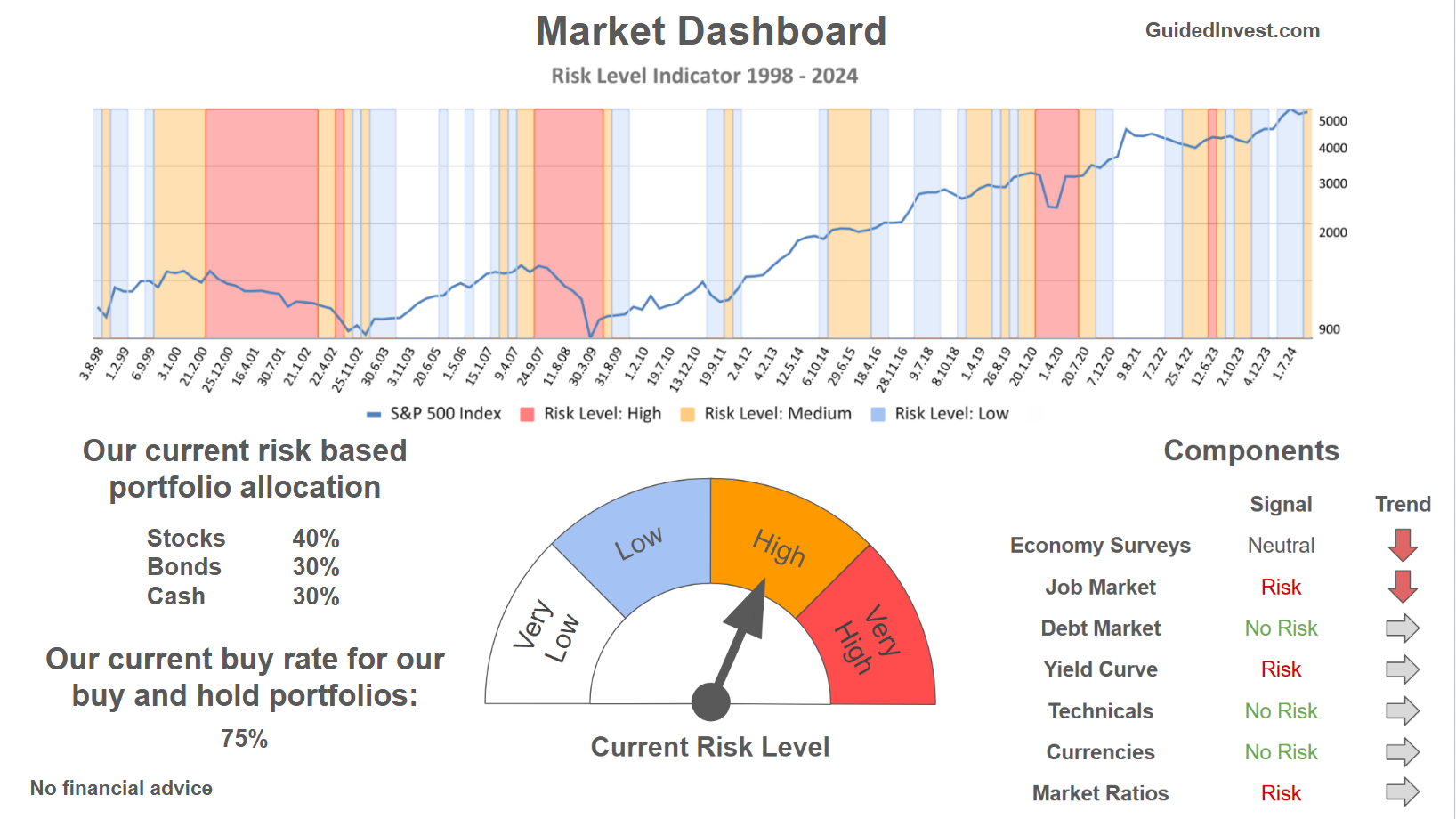

Our Market Dashboard provides a quick overview of the current market conditions and, more importantly, the associated risk. You can view a chart of one of our tools, the Risk Level Indicator, showing predicted risk from 1998 to 2024. If you are interested, you can visit our Dashboard site here.

The world of finance is complex and includes many technical terms. For explanations of these terms, I recommend using the Investopedia dictionary.

Leave a Reply