Welcome to our weekly newsletter covering the latest on the S&P 500. This past week, the index had a loss of 1.3%, continuing a sluggish pattern seen over the past couple of weeks.

A Sluggish Start with a Steep Mid-Week Decline

Early in the week, the S&P 500 maintained its sluggish, sideways movement, mirroring trends from the past two weeks. Monday and Tuesday saw little action, but by Thursday, a sharper-than-expected decline hit the index, with the S&P dropping over 2%. Friday showed a slight bounce back, but overall, the week leaned downward, staying in what could be described as a correctional phase.

For the past few weeks, the market has moved sideways with a slight downward trend but without strong momentum, which often signals a corrective process. Thursday’s decline, however, appeared more impulsive, potentially indicating a continuation of the current downtrend. However, there is also the chance that this correction might end with a V-shaped recovery, where a sharp drop is followed by a similarly sharp bounce. With election season adding uncertainty, next week’s market movements could be full of surprises.

Our last position, which we placed on August 8th, has been active until September 5th, when we sold it for a gain of 7.7%

Are you wondering when to buy the S&P 500 as an investor? Explore our tailored services and join our growing community of do-it-yourself investors who have successfully navigated the market with our guidance.

Premium Guide

Advanced Investing Signals

$139 / Month

Basic Guide

Basic Investing

Signals

$49 / Month

Simple Guide

Selected

Signals

Free

Congratulations! You’ve discovered your new free financial guide. Simply sign up for our most popular service, our Simple Guide.

Watch the Orange Trendline

Since reaching a low in August, the S&P 500 has gained 12.6%, creating an interesting setup on the daily chart. Last week, we discussed a rising wedge formation, which combines two red trend lines on the upside of the weekly chart, representing long-term resistance. Meanwhile, two orange trend lines on the lower side have created a support zone. Together, these lines define a wedge pattern, which often leads to a price breakout in one direction.

This past week, the S&P 500 moved down toward the lower orange trend line and bounced slightly on Friday, underscoring the importance of this support level. Now, the key question is whether the index will continue to find support at these levels or if it will break below the orange lines, ending the wedge formation and possibly leading to a deeper correction.

With the election coming up, we’re likely to see heightened market volatility. Typically, election periods can bring sudden shifts, and markets often anticipate the impact of election outcomes, so next week could see some bigger-than-normal swings. It’s also worth noting that with this week’s sell-off, the S&P 500 is no longer in an “overbought” position on the daily level, meaning it has a bit more room to rise. Had the index been overbought, it might have had more downside potential heading into the election. Now, it appears closer to neutral ground, leaving both upside and downside potential open.

For subscribers it is very important to follow our risk management measures that we provide with all our services to protect against losses in case support zones break

The next few months

Historically, the S&P 500 tends to show seasonal patterns, with certain times of the year seeing more predictable trends. Tracking these patterns can offer investors insights into potential movements in the index. We see a tendency for market weakness in May, June, and July, followed by a period of strong price gains up to early September. However, this is usually succeeded by a larger correction leading up to the election at the beginning of November. The period from mid-June to the end of July is characterized by some market softness, with only modest upward movement, which aligns with the recent declines we’ve witnessed. As we are in November, which is historically a stronger month of the year, we may continue to see this pattern of volatility. Given the historical data, there could be further weakness until the U.S. election on November 5th. However, it’s important to interpret this seasonality with caution, especially this year, as we have already experienced a significant rise in prices. Investors should consider both seasonality trends and our analysis for a balanced view. Proper risk management is essential in navigating these market conditions.

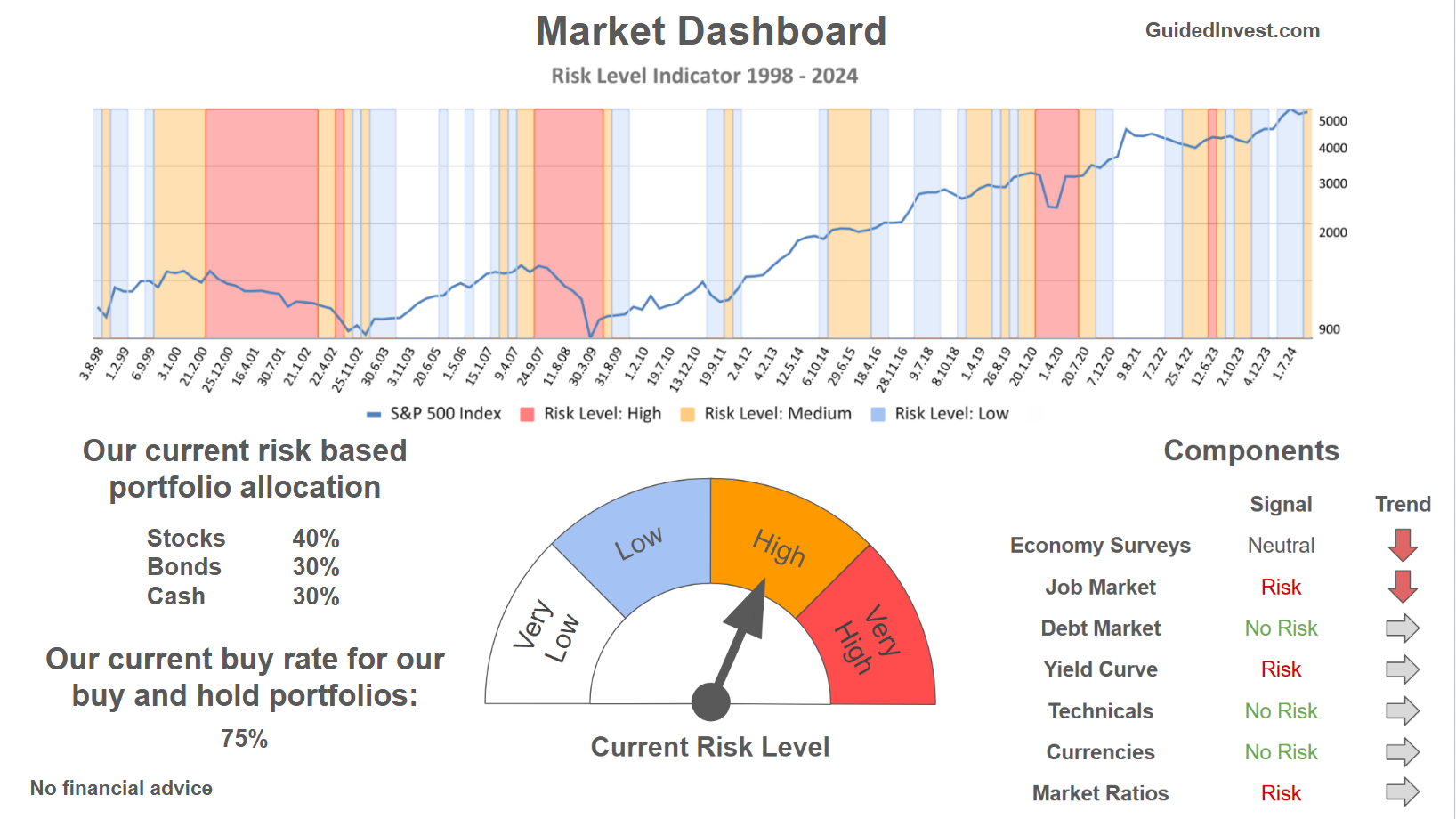

Our Market Dashboard provides a quick overview of the current market conditions and, more importantly, the associated risk. You can view a chart of one of our tools, the Risk Level Indicator, showing predicted risk from 1998 to 2024. If you are interested, you can visit our Dashboard site here.

The world of finance is complex and includes many technical terms. For explanations of these terms, I recommend using the Investopedia dictionary.

Leave a Reply