Tag: #Trading

-

Top ETFs Near Support: What to Watch and Where to Trim

Welcome to our ETF update. We provide an overview of different ETFs across various asset classes and base our analysis on technicals. We list some ETFs that, from a risk/reward perspective, currently look like good buy opportunities, and others that are better suited as sell or take-profit options right now. Want to know the best…

-

Weekly Update S&P 500

Hello everybody, and welcome to this week’s analysis of the S&P 500. We had another quite volatile week, with the index closing down about 0.6%. As you can see on the 4-hour chart, we experienced a strong gap down on Monday, followed by further downside pressure into midweek. The market made a low on Wednesday,…

-

S&P 500: The Big Picture

Hello and welcome to our big picture analysis of the S&P 500. We’re starting here by looking at the monthly and weekly candle charts. We begin with the long-term trend from 2008 to today. We’re in a very clean rising trend channel, which gives us a good sense of the overall structure. To better understand…

-

Weekly Update S&P 500

Hello everybody, and welcome to this week’s analysis of the S&P 500. We had a very choppy week with a lot of ups and downs, and overall the index closed about 0.3% below last week’s close. Looking at the 4-hour chart, we can clearly see this back-and-forth price action throughout the entire week. Monday was…

-

Top ETFs Near Support: What to Watch and Where to Trim

Welcome to our ETF update. We provide an overview of different ETFs across various asset classes and base our analysis on technicals. We list some ETFs that, from a risk/reward perspective, currently look like good buy opportunities, and others that are better suited as sell or take-profit options right now. Want to know the best…

-

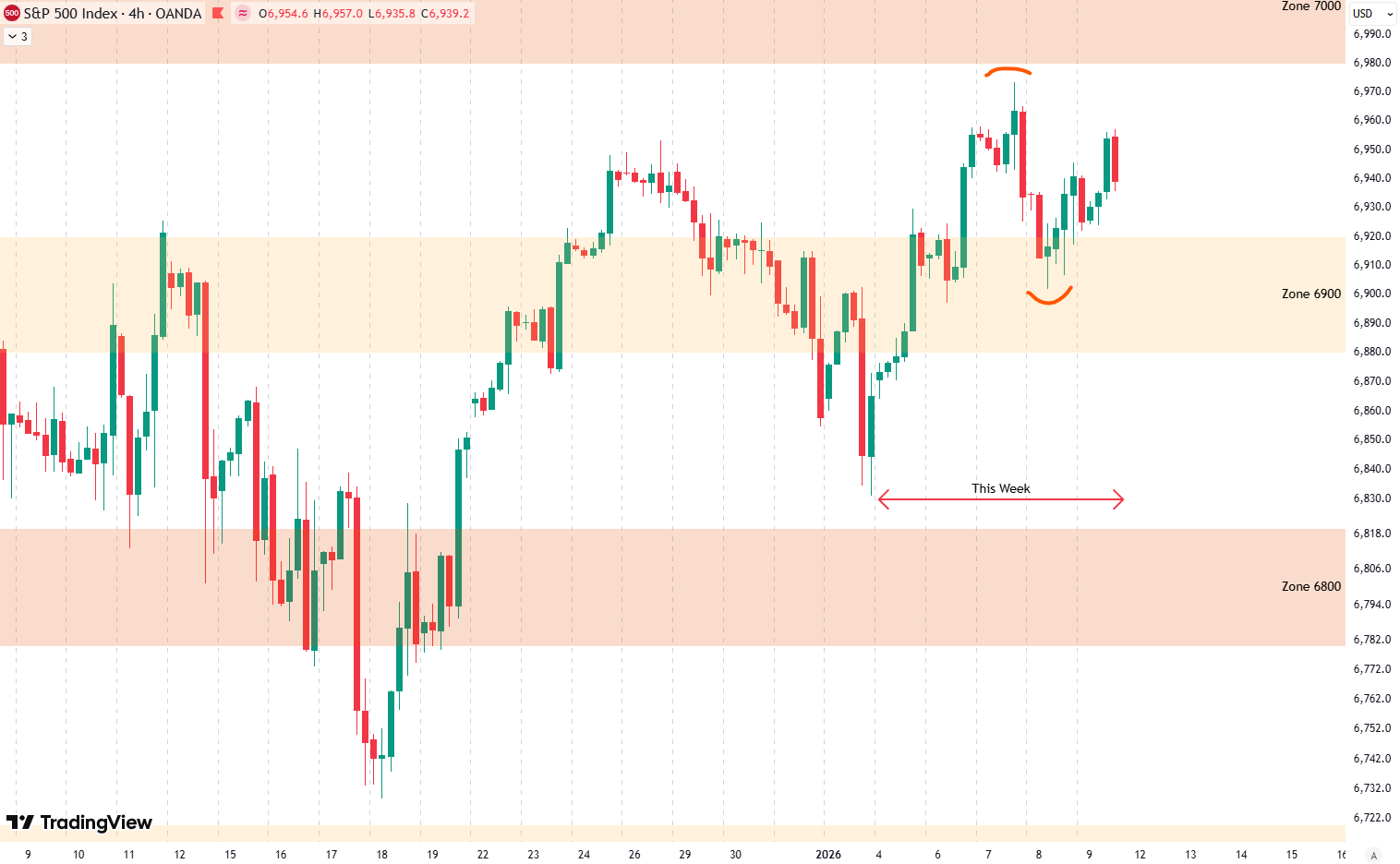

Weekly Update S&P 500

Hello everybody, and welcome to this week’s analysis of the S&P 500. I’m writing this right around the New York market open on Friday, so the final trading day of the week is not fully included yet. So far, it has been a solid week, with the index up about 1.1%. Looking at the 4-hour…

-

Analyzing 100 Years of the S&P 500: A Technical Perspective

When it comes to understanding the S&P 500 on a long-term scale, there’s nothing quite like zooming out. By looking at a yearly chart, where each candle represents one year of market movement, we gain valuable perspective. Spanning more than 100 years, this approach offers clarity about where we stand today while letting us analyze…

-

Weekly Update S&P 500

Hello everybody, and welcome to this week’s analysis of the S&P 500. We had a somewhat weak week, with the index down about 1%. Looking at the 4-hour chart, we can see this week’s price action clearly. After reaching a new all-time high last Friday, just after Christmas, the market started to decline from Monday…

-

Top ETFs Near Support: What to Watch and Where to Trim

Welcome to our ETF update. We provide an overview of different ETFs across various asset classes and base our analysis on technicals. We list some ETFs that, from a risk/reward perspective, currently look like good buy opportunities, and others that are better suited as sell or take-profit options right now. Want to know the best…

-

Weekly Update S&P 500

Welcome to this week’s analysis of the S&P 500. We had a very solid trading week, slightly shortened due to the Christmas holidays. I hope you all had a great Christmas with your families. The S&P 500 also had a strong holiday week, gaining about 1.3%. Looking at the 4-hour chart, we can see a…