Schlagwort: #RiskManagement

-

Understanding Alibaba’s Stock Movement – Is a New Buying Opportunity on the Horizon?

Alibaba, the Chinese e-commerce giant, has been making some interesting moves on the stock market lately, and if you’re a beginner investor, this might be a stock to keep an eye on. Let’s break down what’s been happening with Alibaba’s stock since May 2024 and why now could be a great time to consider an…

-

Understanding Position Sizing and Trade Management

Introduction to Position Sizing In this article, we’ll dive into the basics of position sizing within a portfolio and how it relates to trade management. Position sizing isn’t about thinking in terms of dollar amounts but in percentages of your portfolio’s overall value. This approach helps you manage risk and ensure your trades are proportional…

-

Wöchentliches Update S&P 500

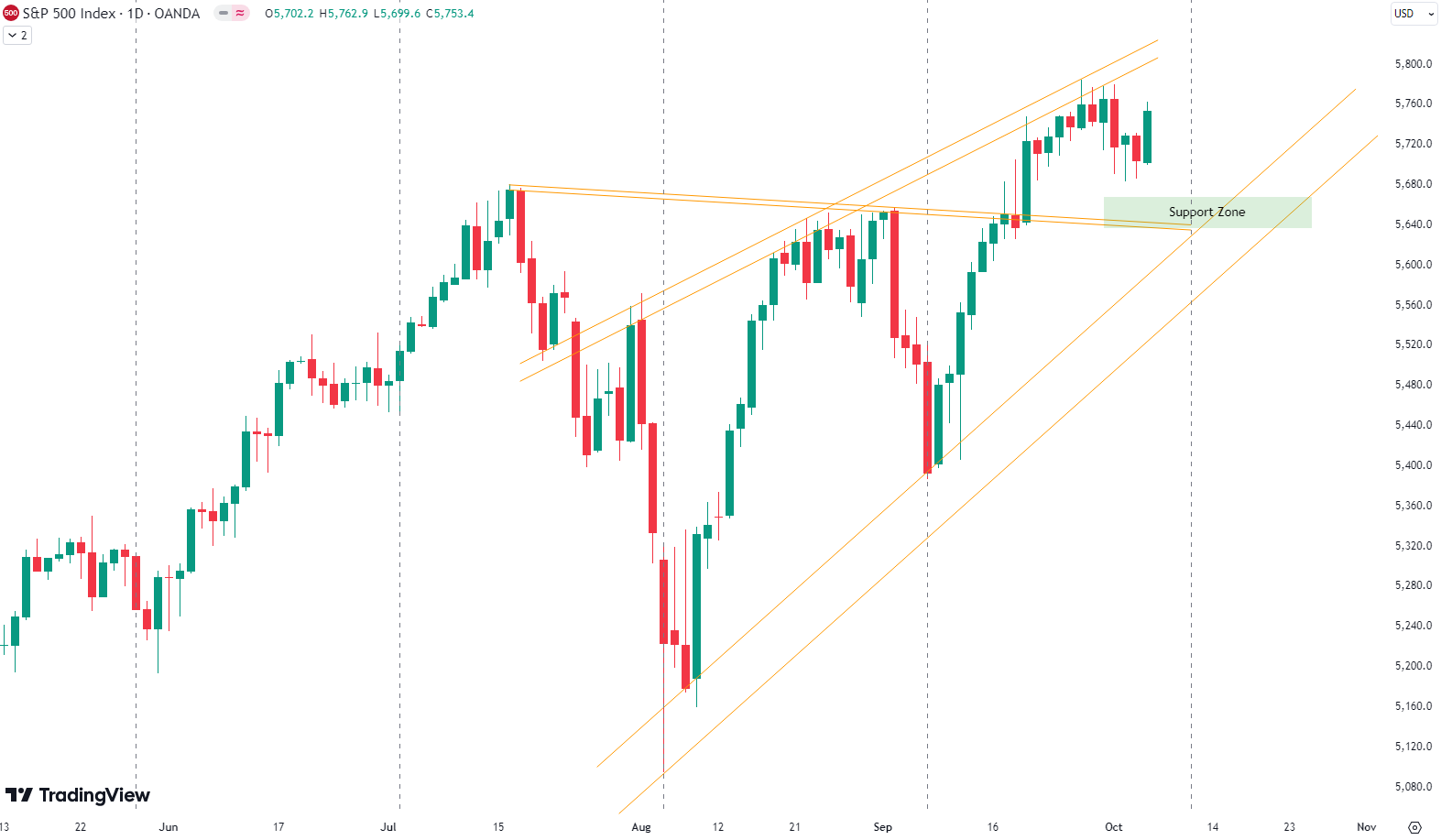

This week, the S&P 500 experienced a modest 0.2% gain. As you can see from the chart, the market followed a slow-moving path, showing limited action. Last week’s newsletter mentioned the gray trend line on the one-hour chart, and on Friday, the S&P 500 broke below that line. On Monday and Tuesday, the index failed…

-

New Trading Signal

S&P 500 Short Signal – October 2, 2024 Entry PointWe’re initiating a short position on the S&P 500 at around 5701.5 points. To enter this trade, consider buying an S&P 500 short ETF. As the market declines, the price of the short ETF will increase. The recommended portfolio allocation for this trade is between 0.25%…

-

Wöchentliches Update S&P 500

Welcome to our weekly newsletter on the S&P 500! This week, the S&P 500 recorded a modest gain of 0.5%, climbing steadily each day. While the upward movement was gradual, it was consistent. If you look at the one-hour chart, you’ll see the price forming a clear upward-sloping trendline (grey on the chart). The price…

-

Nvidia forms Wedge

This week, we’re diving back into Nvidia. A few weeks ago, we discussed the company and focused on its price movements around a key logarithmic trend line. Since mid-June, Nvidia has seen wild swings, with 20-30% fluctuations in both directions. Are you wondering when to buy Nvidia as an investor? Explore our tailored services and…

-

Wöchentliches Update S&P 500

Welcome to our weekly update on the S&P 500! This week, the S&P 500 gained 1.6%, continuing its positive momentum. The first half of the week saw relatively little movement, as traders waited for the big Federal Reserve meeting on Wednesday. As the market expected, the Fed cut rates by 0.5%, which initially triggered a…

-

ETFs vs. Stocks: Which is Better for You

What’s an ETF, Anyway? Let’s start with the basics: an ETF (Exchange-Traded Fund) is essentially a bundle of different stocks or other assets. Think of it like a basket full of investments—most commonly stocks. So, if you buy an ETF that tracks the S&P 500, you’re buying a slice of the entire S&P 500. The…

-

Wöchentliches Update S&P 500

This week was particularly strong for the S&P 500, which gained 4.3%. The market saw minor increases on Monday, followed by a flat Tuesday. However, Wednesday was a rollercoaster of volatility, with a sharp drop of 1.7% within two hours before rallying with an impressive 2.9% rise into the close. Thursday and Friday continued to…

-

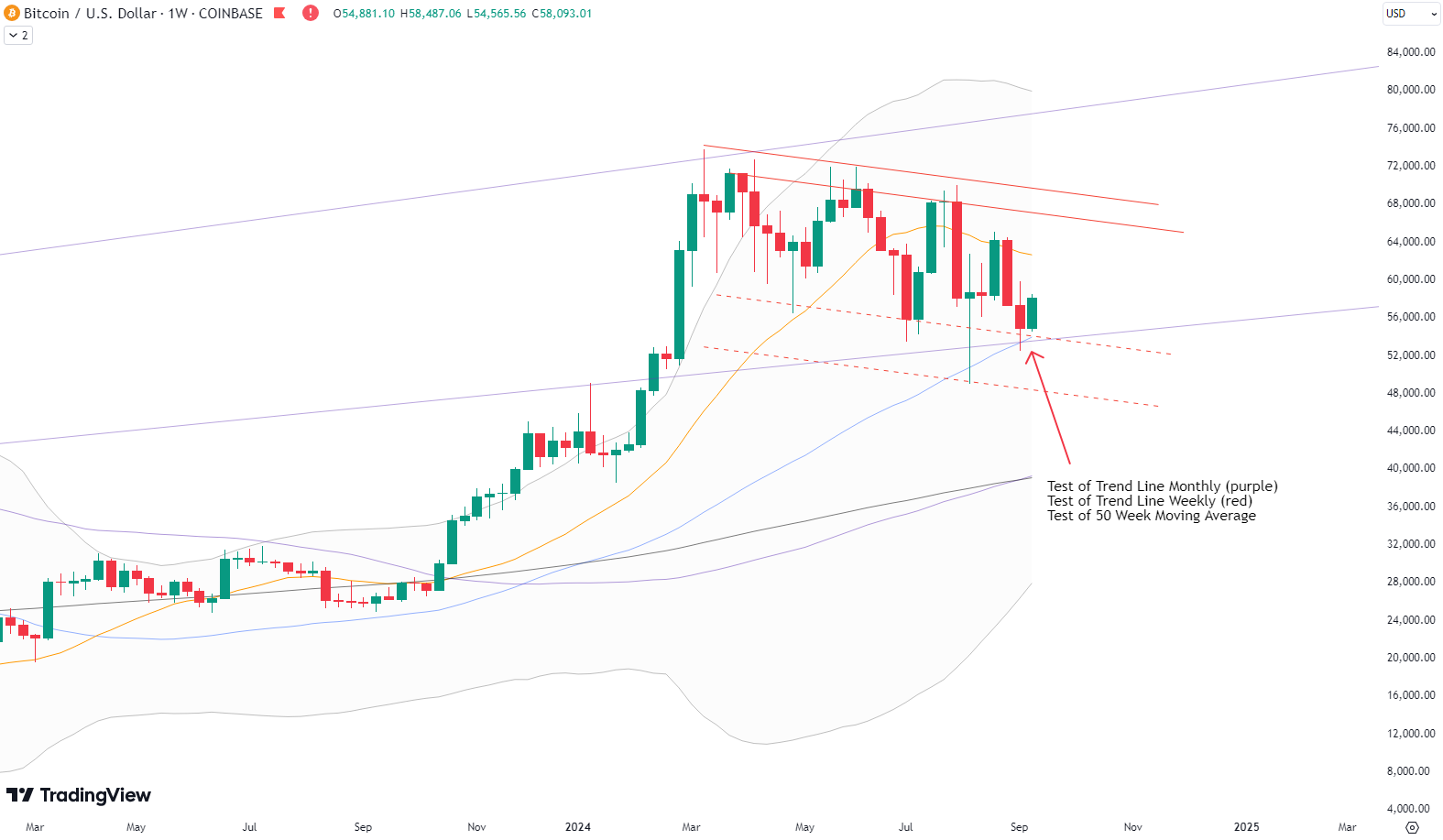

Bitcoin Finds Strong Support

This week, we are focusing on Bitcoin’s price movements and analyzing key technical indicators. Are you wondering when to buy Bitcoin as an investor? Explore our tailored services and join our growing community of do-it-yourself investors who have successfully navigated the market with our guidance. Premium GuideAdvanced Investing Signals$139 / Month Basic GuideBasic Investing Signals$49…