Schlagwort: #InvestmentStrategy

-

Wöchentliches Update S&P 500

Welcome to our weekly newsletter covering the latest on the S&P 500. This past week, the index had a loss of 1.3%, continuing a sluggish pattern seen over the past couple of weeks. A Sluggish Start with a Steep Mid-Week Decline Early in the week, the S&P 500 maintained its sluggish, sideways movement, mirroring trends…

-

ASML’s Stock Price Drop: Opportunity or Risk?

ASML, a European tech giant, plays a pivotal role in the chip-making industry by producing machines essential to high-end chip manufacturing worldwide. This company’s influence on tech cannot be overstated. ASML’s stock, which has seen long-term growth, is a popular focus for investors, especially as recent market trends bring it near a potential buying opportunity.…

-

Wöchentliches Update S&P 500

Welcome to our weekly S&P 500 newsletter. This week, the S&P 500 experienced a 1.0% gain despite a highly volatile trading pattern. After last week’s signals of an overbought market, a pullback seemed likely, and indeed, the index saw significant shifts throughout the week. From Monday through Wednesday, the S&P 500 experienced a steady decline,…

-

Wöchentliches Update S&P 500

Welcome to our weekly newsletter on the S&P 500. This week, the S&P 500 experienced a 0.8% gain, reflecting a relatively volatile trading period. After breaking out of the wedge formation discussed in last week’s update, the index saw significant movement. The S&P 500 enjoyed a strong rise on Monday, followed by a sell-off on…

-

Bitcoin Approaching Critical Levels

Bitcoin has had an exciting journey this year. After a strong run-up in February and March, prices reached impressive levels before settling into a consolidation range. For those unfamiliar, this means that Bitcoin has been bouncing between two key levels: $70,000 at the top (resistance) and $56,000 to $58,000 at the bottom (support), without any…

-

Wöchentliches Update S&P 500

Welcome to our weekly newsletter on the S&P 500! This week, the S&P 500 saw a solid gain of 1.1%, reflecting strong momentum in the market. Looking at the 4-hour chart, the index has been forming a wedge pattern since early October. This pattern, shown by the green trend lines, indicates some corrective sideways action.…

-

Understanding Alibaba’s Stock Movement – Is a New Buying Opportunity on the Horizon?

Alibaba, the Chinese e-commerce giant, has been making some interesting moves on the stock market lately, and if you’re a beginner investor, this might be a stock to keep an eye on. Let’s break down what’s been happening with Alibaba’s stock since May 2024 and why now could be a great time to consider an…

-

Understanding Position Sizing and Trade Management

Introduction to Position Sizing In this article, we’ll dive into the basics of position sizing within a portfolio and how it relates to trade management. Position sizing isn’t about thinking in terms of dollar amounts but in percentages of your portfolio’s overall value. This approach helps you manage risk and ensure your trades are proportional…

-

Wöchentliches Update S&P 500

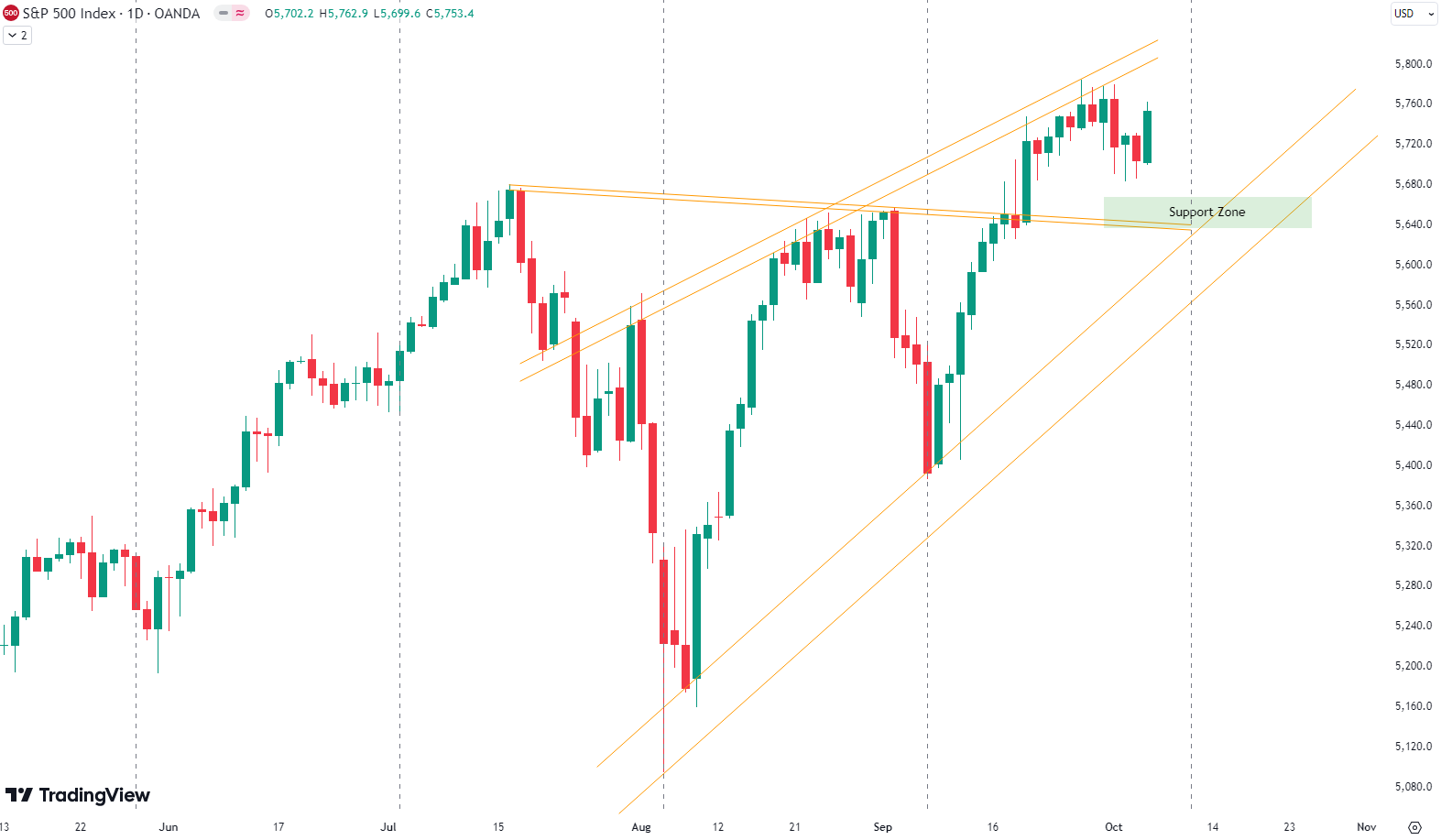

This week, the S&P 500 experienced a modest 0.2% gain. As you can see from the chart, the market followed a slow-moving path, showing limited action. Last week’s newsletter mentioned the gray trend line on the one-hour chart, and on Friday, the S&P 500 broke below that line. On Monday and Tuesday, the index failed…

-

New Trading Signal

S&P 500 Short Signal – October 2, 2024 Entry PointWe’re initiating a short position on the S&P 500 at around 5701.5 points. To enter this trade, consider buying an S&P 500 short ETF. As the market declines, the price of the short ETF will increase. The recommended portfolio allocation for this trade is between 0.25%…