Welcome to our weekly newsletter covering the latest on the S&P 500. This past week, the index had a loss of 1.3%, continuing a sluggish pattern seen over the past couple of weeks.

A Sluggish Start with a Steep Mid-Week Decline

Early in the week, the S&P 500 maintained its sluggish, sideways movement, mirroring trends from the past two weeks. Monday and Tuesday saw little action, but by Thursday, a sharper-than-expected decline hit the index, with the S&P dropping over 2%. Friday showed a slight bounce back, but overall, the week leaned downward, staying in what could be described as a correctional phase.

For the past few weeks, the market has moved sideways with a slight downward trend but without strong momentum, which often signals a corrective process. Thursday’s decline, however, appeared more impulsive, potentially indicating a continuation of the current downtrend. However, there is also the chance that this correction might end with a V-shaped recovery, where a sharp drop is followed by a similarly sharp bounce. With election season adding uncertainty, next week’s market movements could be full of surprises.

Our last position, which we placed on August 8th, has been active until September 5th, when we sold it for a gain of 7.7%

Sie fragen sich, wann Sie als Investor den S&P 500 kaufen sollten? Entdecken Sie unsere maßgeschneiderten Dienstleistungen und schließen Sie sich unserer wachsenden Gemeinschaft von Do-it-yourself-Investoren an, die sich mit unserer Anleitung erfolgreich auf dem Markt zurechtgefunden haben.

Premium Guide

Advanced Investing Signals

139€ / Monat

Basic Guide

Basic Investing

Signals

49€ / Monat

Simple Guide

Selected

Signals

Kostenfrei

Congratulations! You’ve discovered your new free financial guide. Simply sign up for our most popular service, our Simple Guide.

Watch the Orange Trendline

Since reaching a low in August, the S&P 500 has gained 12.6%, creating an interesting setup on the daily chart. Last week, we discussed a rising wedge formation, which combines two red trend lines on the upside of the weekly chart, representing long-term resistance. Meanwhile, two orange trend lines on the lower side have created a support zone. Together, these lines define a wedge pattern, which often leads to a price breakout in one direction.

This past week, the S&P 500 moved down toward the lower orange trend line and bounced slightly on Friday, underscoring the importance of this support level. Now, the key question is whether the index will continue to find support at these levels or if it will break below the orange lines, ending the wedge formation and possibly leading to a deeper correction.

With the election coming up, we’re likely to see heightened market volatility. Typically, election periods can bring sudden shifts, and markets often anticipate the impact of election outcomes, so next week could see some bigger-than-normal swings. It’s also worth noting that with this week’s sell-off, the S&P 500 is no longer in an “overbought” position on the daily level, meaning it has a bit more room to rise. Had the index been overbought, it might have had more downside potential heading into the election. Now, it appears closer to neutral ground, leaving both upside and downside potential open.

For subscribers it is very important to follow our risk management measures that we provide with all our services to protect against losses in case support zones break

Die nächsten Monate

Historically, the S&P 500 tends to show seasonal patterns, with certain times of the year seeing more predictable trends. Tracking these patterns can offer investors insights into potential movements in the index. We see a tendency for market weakness in May, June, and July, followed by a period of strong price gains up to early September. However, this is usually succeeded by a larger correction leading up to the election at the beginning of November. The period from mid-June to the end of July is characterized by some market softness, with only modest upward movement, which aligns with the recent declines we’ve witnessed. As we are in November, which is historically a stronger month of the year, we may continue to see this pattern of volatility. Given the historical data, there could be further weakness until the U.S. election on November 5th. However, it’s important to interpret this seasonality with caution, especially this year, as we have already experienced a significant rise in prices. Investors should consider both seasonality trends and our analysis for a balanced view. Proper risk management is essential in navigating these market conditions.

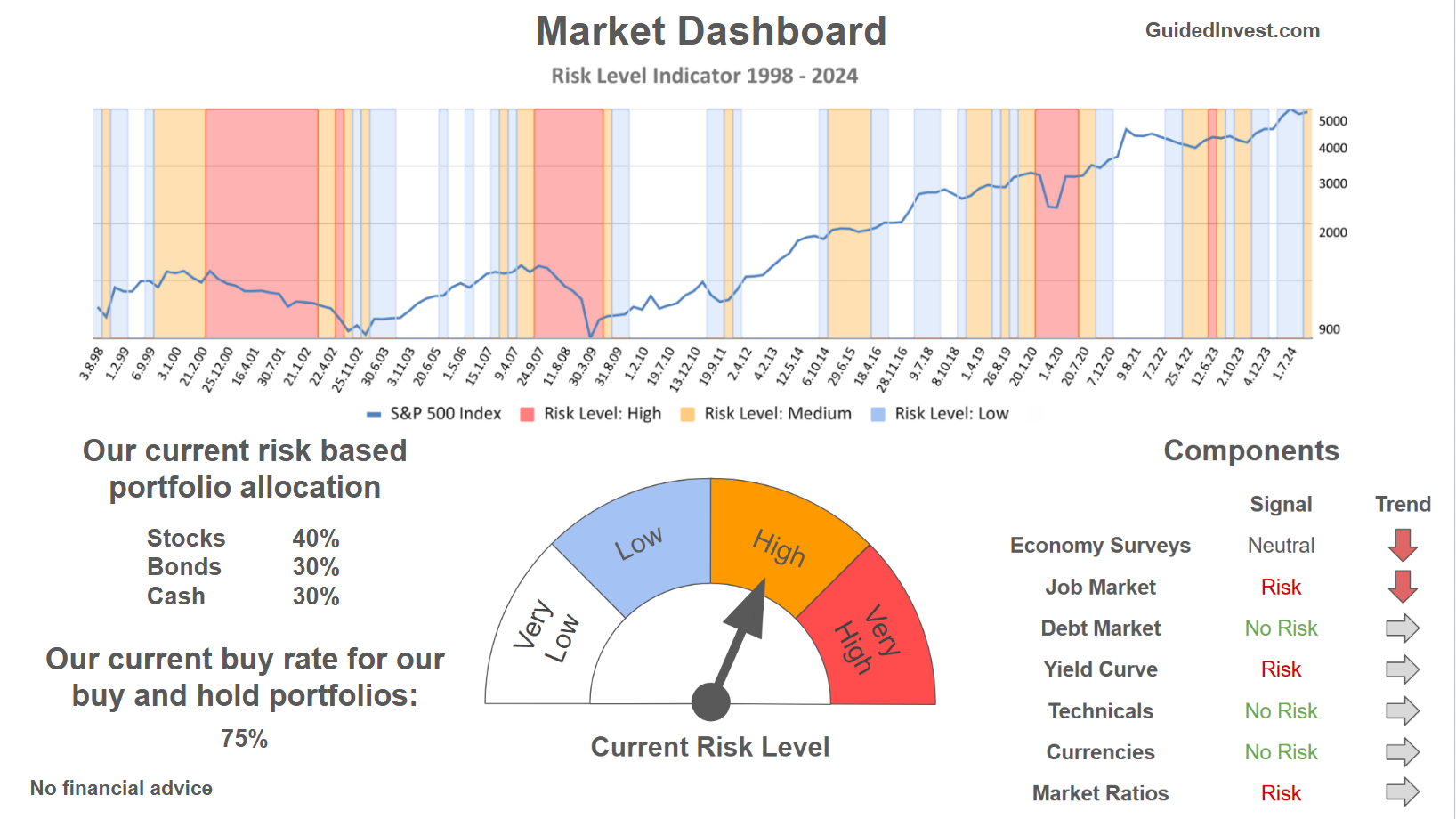

Unser Markt-Dashboard bietet einen schnellen Überblick über die aktuellen Marktbedingungen und, was noch wichtiger ist, das damit verbundene Risiko. Unten sehen sie ein Chart eines unserer Tools, des Risiko-Level-Indikators. Es zeigt das prognostizierte Risiko von 1998 bis 2024. Wenn Sie interessiert sind, können Sie hier unsere Dashboard-Seite besuchen..

Die Welt der Finanzen ist komplex und umfasst viele Fachbegriffe. Für die Erklärung dieser Begriffe empfehle ich das Lexikon von Investopedia. Investopedia dictionary.

Schreibe einen Kommentar