- Top ETFs Near Support: What to Watch and Where to TrimWelcome to our ETF update. We provide an overview of different ETFs across various asset classes and base our analysis on technicals. We list some ETFs that, from a risk/reward perspective, currently look like good buy opportunities, and others that are better suited as sell or take-profit options right now. Want to know the best… Read more: Top ETFs Near Support: What to Watch and Where to Trim

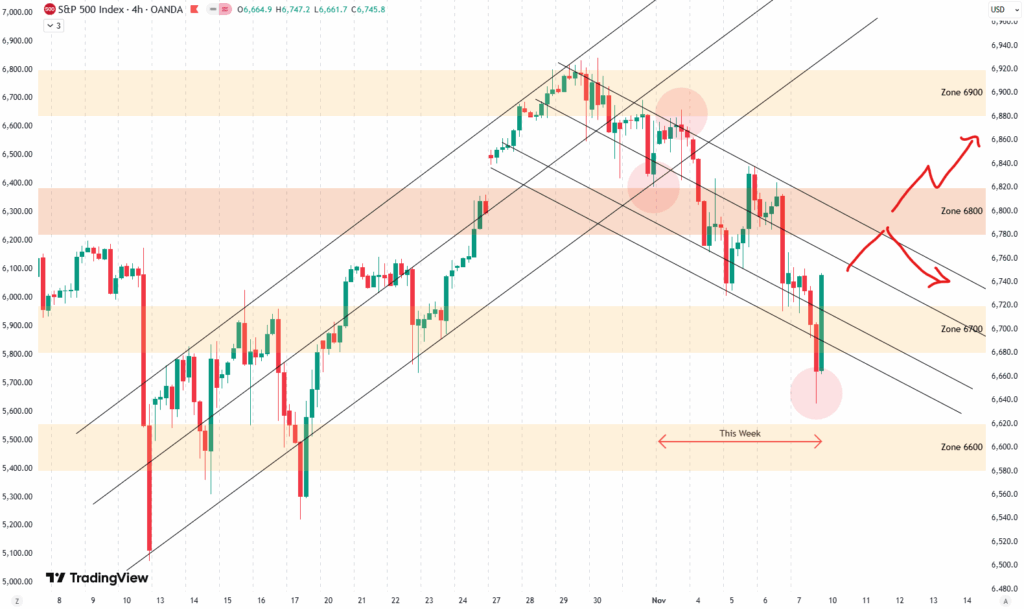

- Weekly Update S&P 500Hello everybody, and welcome to this week’s analysis of the S&P 500. We had another quite volatile week, with the index closing down about 0.6%. As you can see on the 4-hour chart, we experienced a strong gap down on Monday, followed by further downside pressure into midweek. The market made a low on Wednesday,… Read more: Weekly Update S&P 500

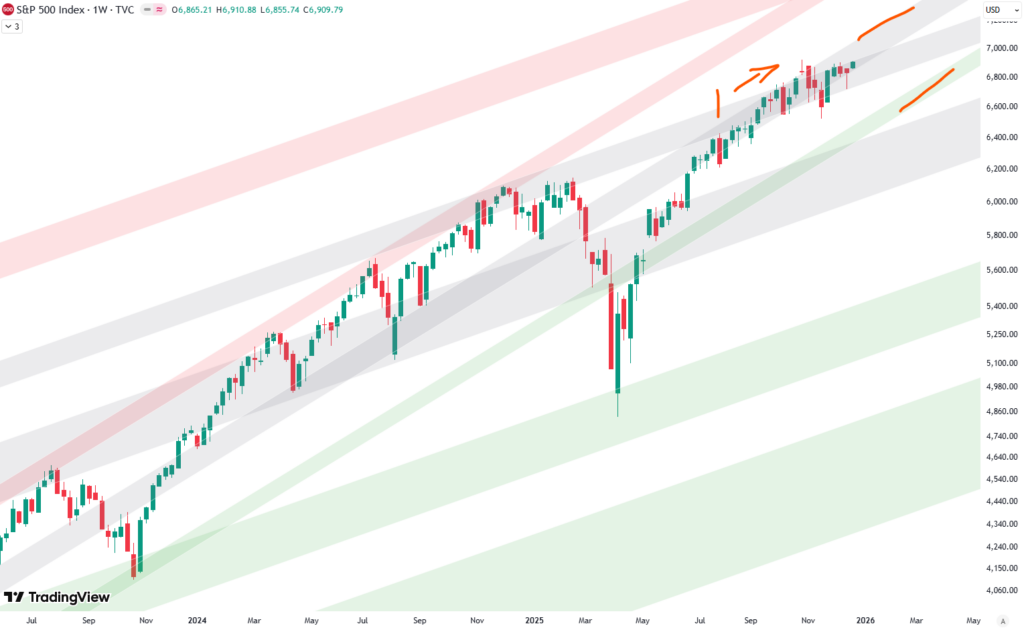

- S&P 500: The Big PictureHello and welcome to our big picture analysis of the S&P 500. We’re starting here by looking at the monthly and weekly candle charts. We begin with the long-term trend from 2008 to today. We’re in a very clean rising trend channel, which gives us a good sense of the overall structure. To better understand… Read more: S&P 500: The Big Picture

- Weekly Update S&P 500Hello everybody, and welcome to this week’s analysis of the S&P 500. We had a very choppy week with a lot of ups and downs, and overall the index closed about 0.3% below last week’s close. Looking at the 4-hour chart, we can clearly see this back-and-forth price action throughout the entire week. Monday was… Read more: Weekly Update S&P 500

- Top ETFs Near Support: What to Watch and Where to TrimWelcome to our ETF update. We provide an overview of different ETFs across various asset classes and base our analysis on technicals. We list some ETFs that, from a risk/reward perspective, currently look like good buy opportunities, and others that are better suited as sell or take-profit options right now. Want to know the best… Read more: Top ETFs Near Support: What to Watch and Where to Trim

- Weekly Update S&P 500Hello everybody, and welcome to this week’s analysis of the S&P 500. I’m writing this right around the New York market open on Friday, so the final trading day of the week is not fully included yet. So far, it has been a solid week, with the index up about 1.1%. Looking at the 4-hour… Read more: Weekly Update S&P 500

- Analyzing 100 Years of the S&P 500: A Technical PerspectiveWhen it comes to understanding the S&P 500 on a long-term scale, there’s nothing quite like zooming out. By looking at a yearly chart, where each candle represents one year of market movement, we gain valuable perspective. Spanning more than 100 years, this approach offers clarity about where we stand today while letting us analyze… Read more: Analyzing 100 Years of the S&P 500: A Technical Perspective

- Weekly Update S&P 500Hello everybody, and welcome to this week’s analysis of the S&P 500. We had a somewhat weak week, with the index down about 1%. Looking at the 4-hour chart, we can see this week’s price action clearly. After reaching a new all-time high last Friday, just after Christmas, the market started to decline from Monday… Read more: Weekly Update S&P 500

- Top ETFs Near Support: What to Watch and Where to TrimWelcome to our ETF update. We provide an overview of different ETFs across various asset classes and base our analysis on technicals. We list some ETFs that, from a risk/reward perspective, currently look like good buy opportunities, and others that are better suited as sell or take-profit options right now. Want to know the best… Read more: Top ETFs Near Support: What to Watch and Where to Trim

- Weekly Update S&P 500Welcome to this week’s analysis of the S&P 500. We had a very solid trading week, slightly shortened due to the Christmas holidays. I hope you all had a great Christmas with your families. The S&P 500 also had a strong holiday week, gaining about 1.3%. Looking at the 4-hour chart, we can see a… Read more: Weekly Update S&P 500

- S&P 500: The Big PictureHello and welcome to our big picture analysis of the S&P 500. We’re starting here by looking at the monthly and weekly candle charts. We begin with the long-term trend from 2008 to today. We’re in a very clean rising trend channel, which gives us a good sense of the overall structure. To better understand… Read more: S&P 500: The Big Picture

- Weekly Update S&P 500Welcome to our weekly newsletter on the S&P 500. I’m writing this before the New York market open on Friday, so the final trading day of the week is not yet included. So far, the S&P 500 is down about 0.3% for the week. Looking at the 4-hour chart, we can see that we already… Read more: Weekly Update S&P 500

- Top ETFs Near Support: What to Watch and Where to TrimWelcome to our ETF update. We provide an overview of different ETFs across various asset classes and base our analysis on technicals. We list some ETFs that, from a risk/reward perspective, currently look like good buy opportunities, and others that are better suited as sell or take-profit options right now. Want to know the best… Read more: Top ETFs Near Support: What to Watch and Where to Trim

- Weekly Update S&P 500Hello everybody, and welcome to this week’s analysis on the S&P 500. I’m writing this shortly after the New York market open on Friday, so not all trading hours for the week are included yet. Still, this week has been quite interesting. On the 4-hour chart, you can see that last Friday we had the… Read more: Weekly Update S&P 500

- Analyzing 100 Years of the S&P 500: A Technical PerspectiveWhen it comes to understanding the S&P 500 on a long-term scale, there’s nothing quite like zooming out. By looking at a yearly chart, where each candle represents one year of market movement, we gain valuable perspective. Spanning more than 100 years, this approach offers clarity about where we stand today while letting us analyze… Read more: Analyzing 100 Years of the S&P 500: A Technical Perspective

- Weekly Update S&P 500Welcome to this week’s update on the S&P 500. Not much happened overall, and the index finished the week with a slight gain of 0.4%.Looking at the 4-hour chart, we discussed last week that a retest of the 6800-point zone was likely. As you can see, we had several tests of that area throughout the… Read more: Weekly Update S&P 500

- Top ETFs Near Support: What to Watch and Where to TrimWelcome to our ETF update. We provide an overview of different ETFs across various asset classes and base our analysis on technicals. We list some ETFs that, from a risk/reward perspective, currently look like good buy opportunities, and others that are better suited as sell or take-profit options right now. Want to know the best… Read more: Top ETFs Near Support: What to Watch and Where to Trim

- Weekly Update S&P 500Hello everybody, and welcome to this week’s analysis on the S&P 500. The index had a very strong week, up around 3.5%. Looking at the 4-hour chart, we can see that last Friday the S&P 500 formed its bottom after the sharp drop on Thursday. The low from Friday, which I marked in red around… Read more: Weekly Update S&P 500

- S&P 500: The Big PictureHello and welcome to our big picture analysis of the S&P 500. We’re starting here by looking at the monthly and weekly candle charts. We begin with the long-term trend from 2008 to today. We’re in a very clean rising trend channel, which gives us a good sense of the overall structure. To better understand… Read more: S&P 500: The Big Picture

- Weekly Update S&P 500Hello everybody, and welcome to our weekly analysis on the S&P 500. I’m writing this shortly after the U.S. market open on Friday, so the full trading week isn’t finished yet. So far, it has been a weak week, with the S&P 500 down about 3.2%.Looking at the 4-hour chart, you can see the black… Read more: Weekly Update S&P 500

- Top ETFs Near Support: What to Watch and Where to TrimWelcome to our ETF update. We provide an overview of different ETFs across various asset classes and base our analysis on technicals. We list some ETFs that, from a risk/reward perspective, currently look like good buy opportunities, and others that are better suited as sell or take-profit options right now. Want to know the best… Read more: Top ETFs Near Support: What to Watch and Where to Trim

- Weekly Update S&P 500Hello everybody, and welcome to this week’s analysis on the S&P 500. It was quite a volatile week. After the very strong bounce last Friday, the S&P 500 continued that strength into the start of this week. On the 4-hour chart, we can see how the index was able to break out of the declining… Read more: Weekly Update S&P 500

- Analyzing 100 Years of the S&P 500: A Technical PerspectiveWhen it comes to understanding the S&P 500 on a long-term scale, there’s nothing quite like zooming out. By looking at a yearly chart, where each candle represents one year of market movement, we gain valuable perspective. Spanning more than 100 years, this approach offers clarity about where we stand today while letting us analyze… Read more: Analyzing 100 Years of the S&P 500: A Technical Perspective

- Weekly Update S&P 500Welcome to this week’s analysis of the S&P 500. It was another very interesting week, with the index closing down 1.5%. Looking at the 4-hour chart, last week we discussed the short-term upward-rising trend channel, which is shown here with the black trend lines. On Friday, we saw a very clean test of the lower… Read more: Weekly Update S&P 500

- Top ETFs Near Support: What to Watch and Where to TrimWelcome to our ETF update. We provide an overview of different ETFs across various asset classes and base our analysis on technicals. We list some ETFs that, from a risk/reward perspective, currently look like good buy opportunities, and others that are better suited as sell or take-profit options right now. Want to know the best… Read more: Top ETFs Near Support: What to Watch and Where to Trim